Own assets or get left behind.

Money is the tokenization of energy — the concentrated, transferable embodiment of human effort, productivity, trust, and value.

1. Money as Energy

Think of money as a token representing units of energy you’ve expended — energy you can later exchange for other goods, services, or future consumption. When you work, teach, build, or create, you’re exerting energy and producing value. In return, you receive money — a claim on someone else’s future energy.

Thus, money is a standardized way to store and transfer human productivity across time and space.

Who Creates the Tokens?

In our modern fiat system, the government — through its central bank — creates the tokens. It defines what “one dollar” is, enforces its use as legal tender, and controls its supply. The banking system amplifies that process through credit creation, effectively multiplying the supply of tokens. In other words, the government defines the token, issues it, and society agrees to use it.

2. Devaluation: When Your Unit of Energy Is Worth Less

Because money is a token of energy, if the number of tokens grows faster than the real output of the economy, the value of each token falls.

Have you ever traveled abroad and wondered why 100 Indian Rupees equal only about one U.S. Dollar, or why currencies in countries like Argentina or Vietnam have so many zeros on their bills?

That’s the visible result of currency devaluation — a gradual or rapid loss of purchasing power caused by governments expanding their money supply faster than their economy grows.

When governments “print” more money — or expand credit — they dilute each existing token’s claim on the same pool of goods and services. Your stored energy (in the form of money) buys less future energy.

3. The U.S. Dollar Since It Was Un-Pegged

In 1971, the U.S. ended the convertibility of the dollar to gold. From that point forward, the dollar became a fiat currency — backed not by a finite commodity, but by government decree and public trust.

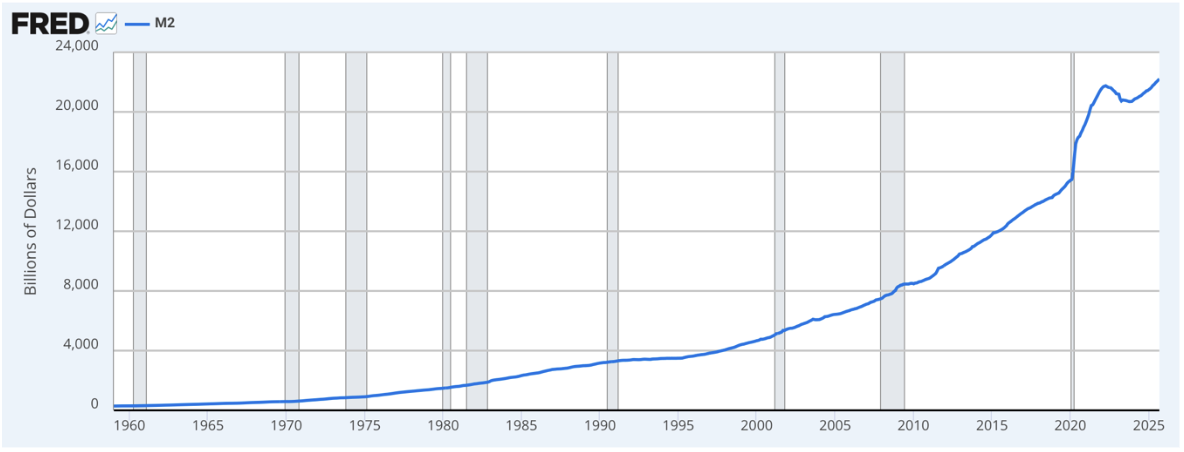

Since the Great Recession and especially through Covid-19, the M2 Money Supply (cash + checking + savings + money market deposits) has exploded.

2008: ~$7.5 trillion

2020: ~$15 trillion

2025: ~$22.2 trillion

As more dollars circulate, each token represents a smaller share of the economy’s productive capacity. Unless output grows just as fast, the result is inflation and asset bubbles.

The Productivity Divide

Since the U.S. ditched the gold standard in 1973, the “American Dream” has been losing its shine.

Productivity has skyrocketed — workers now produce over 2× what they did 50 years ago — but real wages? Barely budged.

That’s not progress; it’s a quiet heist on your labor. Saving won’t save you in a system rigged to devalue your hard work.

To win, you’ve got to own assets that grow as the dollar shrinks.

4. The U.S. Debt & Deficit — The Invisible Tax on Savers

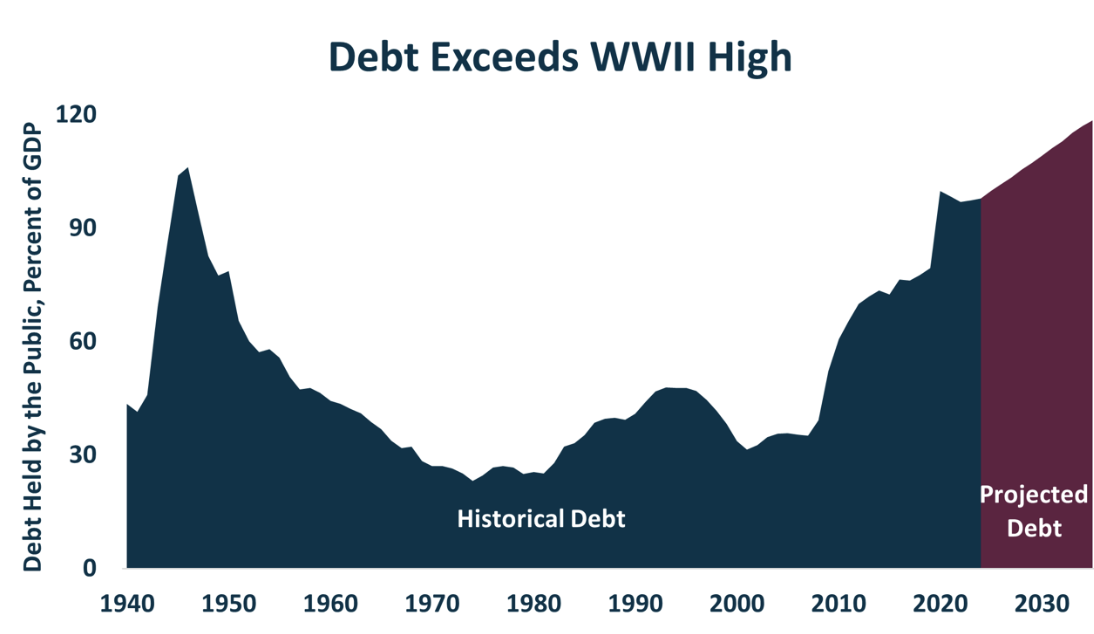

The U.S. federal debt now exceeds $34 trillion, or roughly 124% of GDP. Each year, the government spends more than it collects — the deficit — and fills the gap by issuing Treasury bonds. These same bonds form the foundation of what most savers consider the “safest” investment.

When you buy Treasuries or keep money in a savings account, you are, in effect, lending to the most indebted institution in the world. The government promises to pay you back — but with future dollars that may be worth less.

As deficits persist and the supply of new bonds floods the market, investors demand higher yields to compensate for inflation and risk, putting upward pressure on interest rates. While that may sound positive, it hurts existing bondholders — because when yields rise, bond prices fall, eroding the value of your “safe” investment.

When buyers hesitate to absorb all that debt, the Federal Reserve steps in, creating new dollars to purchase the bonds — effectively printing money to fund government shortfalls. This cycle erodes the value of those same savings, as inflation silently taxes every dollar sitting idle.

The World Is Taking Notice

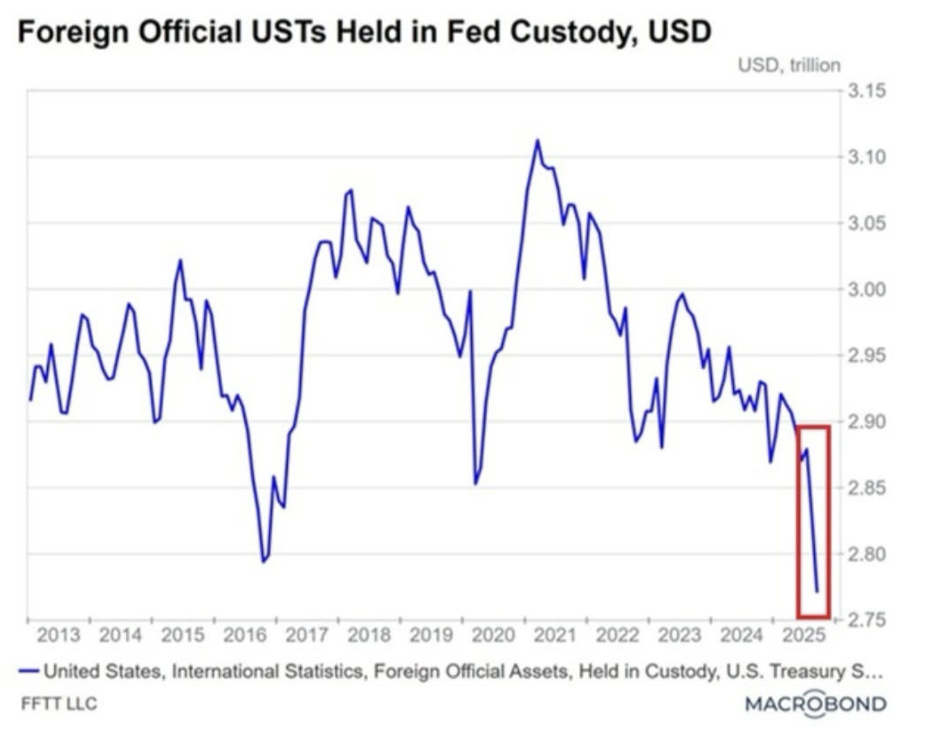

It’s not just domestic investors who see the warning signs. Foreign governments are quietly stepping back from U.S. debt.

Since the 2021 peak, foreign-owned Treasury securities in custody have fallen by over $356 billion, signaling weakening foreign demand for U.S. bonds and growing diversification away from U.S. dollar assets.

This shift isn’t just about portfolio rebalancing — it’s about trust. For decades, the world has relied on the U.S. dollar as the backbone of global trade and reserves. But as America’s debt grows faster than its GDP, and its deficits appear increasingly structural, nations are asking a new question:

how long can the dollar remain the world’s default “store of value”?

The result is a slow but meaningful diversification away from U.S. debt — into gold, commodities, regional currencies, and even digital assets. The global financial order isn’t collapsing, but it is evolving — and the dollar’s dominance may no longer be absolute.

5. Methods of Token Storage

Old Methods of Saving Energy

Long before currency existed, humans still had to store energy — just in physical form.

On the survival show Alone, contestants are dropped into the wilderness with minimal supplies and must balance their limited energy output against their ability to find food, water, and shelter. Every calorie spent must be justified by a potential return of more calories.

They build shelters to conserve body heat, store fish or game so it won’t spoil, and ration energy so they can survive for weeks or months. They’re constantly thinking about storage, protection, and preservation of energy — keeping what they’ve earned safe from time, decay, and predators .

That same instinct drives modern finance. Today, instead of drying fish or building food caches, we store our excess energy in tokens — dollars, investments, or digital assets — all designed to help us consume later what we’ve earned today.

Modern Methods of Token Storage

Savings Accounts

Traditional savings accounts are the most common way people store excess energy. They offer liquidity, stability, and a sense of security — but they’re also the easiest for inflation to erode.

Pros:

- Highly liquid and easy to access.

- FDIC insured up to federal limits.

- Low risk of nominal loss.

Cons:

- Interest rates rarely keep pace with inflation, causing slow but steady loss of purchasing power.

- The dollars in savings are backed by — and diluted by — the same government expanding the money supply.

- In real terms, long-term savers often lose more than they earn.

In short, savings accounts protect your principal, but not your purchasing power.

Bonds

Bonds are loans to governments or corporations, promising a fixed return. While considered “safe,” the environment of growing debt and rising yields has exposed their vulnerability.

Pros:

- Offer predictable income and principal repayment at maturity.

- Useful for diversification and stability in balanced portfolios.

- U.S. Treasuries are backed by the full faith and credit of the U.S. government.

Cons:

- Rising deficits increase bond supply, pushing yields higher and driving prices down.

- Inflation and monetary expansion erode real returns.

- Bonds are often taxed at ordinary income rates, not capital gains.

In today’s debt-driven economy, bonds may offer safety in name only — they’re still exposed to the same silent tax of currency debasement.

Gold

Gold is one of the oldest and most trusted forms of money, valued for its scarcity and independence from government control. It acts as an anchor when paper currencies are being diluted — a hedge against inflation and financial instability.

Pros:

- Scarce and universally recognized store of value.

- Maintains purchasing power across centuries.

- Independent of any government or financial system.

Cons:

- Produces no income or yield.

- Requires physical storage, insurance, and security.

- Large transfers are slow and costly — most clear through the London Bullion Market Exchange (LBMA), involving fees, verification, and insurance.

Gold’s strength lies in its permanence and trust — but that same physicality makes it less practical in a digital, fast-moving world.

Stock Market

Stocks represent ownership in productive enterprises — a claim on future profits and innovation. They’re dynamic and historically strong wealth builders, but their value is highly sensitive to economic cycles and investor sentiment.

Pros:

- Historically outpaces inflation and grows with economic productivity.

- Ownership in real businesses producing goods, services, and dividends.

- Liquid and globally accessible.

Cons:

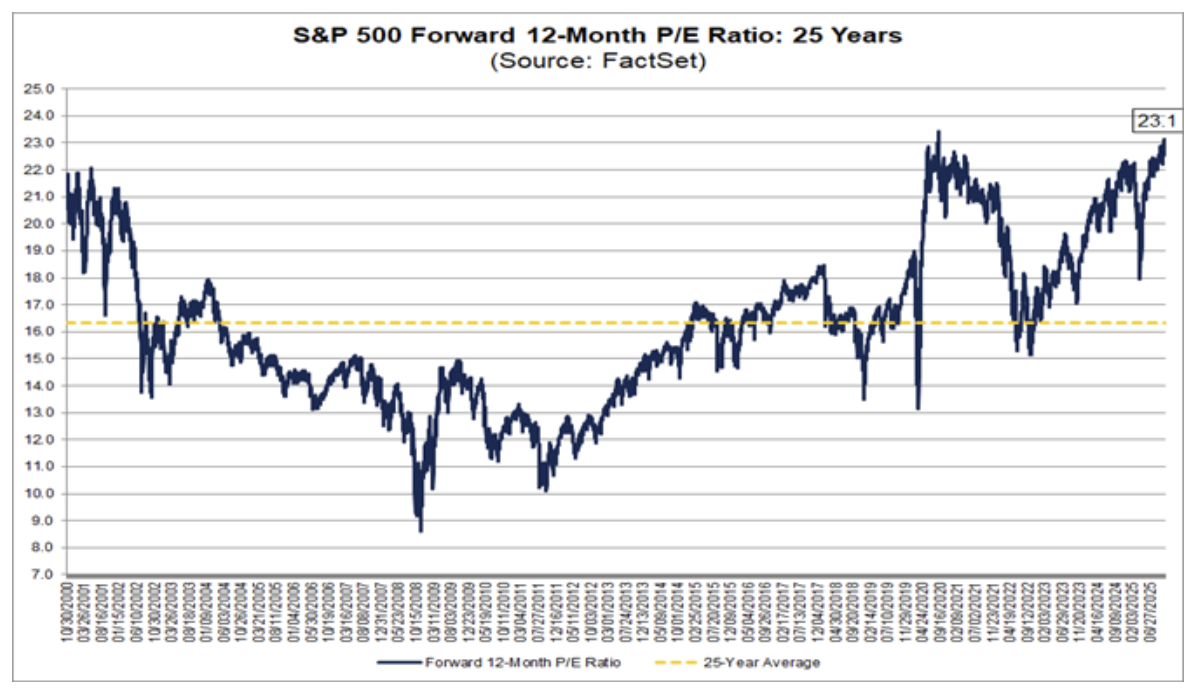

- Valuations are stretched — the S&P 500 trades around 23× earnings, well above the 30-year average of 17×.

- Vulnerable to volatility, earnings compression, and investor speculation.

- Dependent on ongoing corporate growth to justify current prices.

The stock market rewards long-term ownership of productive assets, but at today’s valuations, investors must balance optimism with realism.

Real Estate

Real estate combines physical utility with scarcity. It provides tangible value and inflation protection but also comes with ongoing costs and regional risks.

Pros:

- Inflation hedge with potential rental income.

- Tangible, usable asset that provides housing or utility.

- Finite supply in desirable areas.

Cons:

- High maintenance and carrying costs (repairs, taxes, insurance).

- Vulnerable to natural risks — hurricanes in Florida, fires in California.

- Highly reliant on interest rates — as mortgage costs rise with long-term Treasury yields, property values often fall.

- Illiquid and localized; property values depend on local conditions more than global capital flows.

Real estate builds wealth slowly and locally. It’s powerful over time but lacks liquidity and universality — and its dependency on bond-driven interest rates makes it far from immune to the broader debt cycle.

Cryptocurrency

A particular class of digital assets represents a modern rethinking of money. These networks remove governments and central authorities from the process of issuing and managing currency, relying instead on mathematics, transparency, and decentralized consensus mechanisms.

Pros:

• Finite supply: Some digital assets are designed with a hard, capped issuance schedule, preventing inflationary dilution.

• Self-regulated: Monetary policy within these systems is algorithmic and cannot be changed by any single authority.

• Portable and divisible: Units can be transferred globally within minutes, without reliance on traditional financial intermediaries.

• Often compared to “digital gold”: Their scarcity, borderless nature, and resistance to censorship make them attractive as modern stores of value.

Cons:

• High volatility and an evolving regulatory environment introduce uncertainty.

• Digital security is essential; users must protect their private keys and access credentials.

• Not all digital assets share the same level of decentralization, scarcity, or long-term durability.

In essence, this emerging class of decentralized digital tokens is viewed by many as a potential digital successor to traditional hard assets—scarce, secure, globally accessible, and built for a digital age. As society continues shifting online, these assets may simply represent the next evolution in how we store value, much like the evolution from physical photo albums to digital image libraries.

6. Conclusion: The Timeless Quest to Preserve Energy

It’s human nature to store value — to preserve the energy we’ve earned for future generations. In this quest, we seek something scarce, safe, easily transacted, indestructible, impenetrable, and impossible to duplicate out of thin air.

The Bucket Analogy

Imagine a large bucket, constantly being filled with water — those are the dollars entering the system.

Inside that bucket float various assets — stocks, gold, real estate, cryptocurrency.

As more water pours in, the water level rises, lifting all the floats. But ask yourself:

are those assets truly “going up,” or are they simply floating higher because the bucket is being flooded with more currency?

The scarce, safe, easily transacted, indestructible, and irreplicable assets are the ones that rise most visibly — not necessarily because they’re becoming more valuable, but because they’re the most buoyant barometers of monetary expansion.

So, ask yourself:

- Do you trust governments to stop manipulating their currencies?

- Do you believe corporations can grow profits fast enough to justify record valuations?

- Or is there a different, perhaps newer, form of money that will preserve your stored energy better?

- How will you choose to tokenize your energy — and in what form will it endure over the next few generations?

Neil Cain is a certified financial planners with Capital Financial Planners. If you have questions, register for a complimentary checkup. For topics covered in even greater depth, see our YouTube page.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Stock investing includes risks, including fluctuating prices and loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Cryptocurrency and cryptocurrency-related products can be volatile, are highly speculative and involve significant risks including: liquidity, pricing, regulatory, cybersecurity risk, and loss of principal. A cryptocurrency fund may trade at a significant premium to Net Asset Value (NAV). Cryptocurrencies are not legal tender and are not government backed. Cryptocurrencies are non-traditional investments, resulting in a different tax treatment than currency. Federal, state or foreign governments may restrict the use and exchange of cryptocurrency. The use and exchange of cryptocurrency may also be restricted or halted permanently as regulatory developments continue, and regulations are subject to change at any time. Cryptocurrency exchanges may stop operating or permanently shut down due to fraud, technical glitches, hackers, malware, or bankruptcy. The fast price swings in commodities will result in significant volatility in an investor’s holdings. Commodities include increased risks, such as political, economic, and currency instability, and may not be suitable for all investors.